Though the initial critical reception of 1992’s The Muppet Christmas Carol was mixed (a thumbs down on Siskel & Ebert!), modern wisdom and taste have caught up to the precious pointedness of the pint-sized production, with the movie now being lauded as “the greatest Christmas film ever made”.

We do not disagree with that superlative, because how could you with: a Royal Shakespeare Company quality performance from Michael Caine as the stingy and surly Ebenezer Scrooge, Kermit the Frog as an endearing Bob Cratchit, Gonzo the Great as Dickens the Narrator, and, of course, Rizzo the Rat as Himself.

The story of Dickens’ A Christmas Carol, even without Henson’s creatures, is beloved for its powerful lessons about redemption, generosity, compassion, presence, and forgiveness. At its core, it is a story about learning from your past and making better decisions about your future.

It is with this spirit that we approach this last Weekly Edge of 2025. What lessons can we learn from 2025 and how can we use these lessons to make better decisions in 2026?

So, just as Scrooge was visited by three ghosts to illuminate his reflection and transformation, you will be visited by three sets of charts: The Charts of Christmas Past (a look at dynamics from 2025 that could have fading influence on 2026), The Charts of Christmas Present (those dynamics that will have continued influence on 2026), and The Charts of Christmas Yet to Come (the setup and starting point for the markets and economy into 2026).

Let the bells toll one and our Muppet-led journey begin.

The Charts of Christmas Past

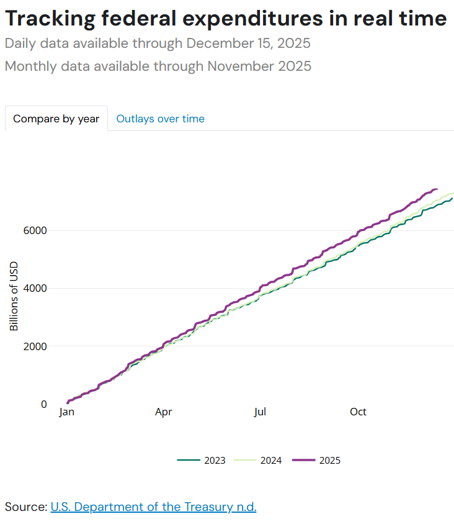

1. DOGE’s Day in the Sun: 2025 opened with a blitz of efforts to curtail U.S. federal spending. It started with layoffs and buyouts for hundreds of thousands of employees and eventually sprawled out to include the shuttering of entire agencies. Ultimately, the Department of Government Efficiency (DOGE) shuttered without making a dent in the rate of growth of federal spending. Austerity and efficiency do not appear to be on the agenda in 2026, either. Though bond vigilantes seem to remain in hibernation, the potential for even wider deficits in 2026, as promises are made in a midterm election year, may stir deficit hawks from their slumber.

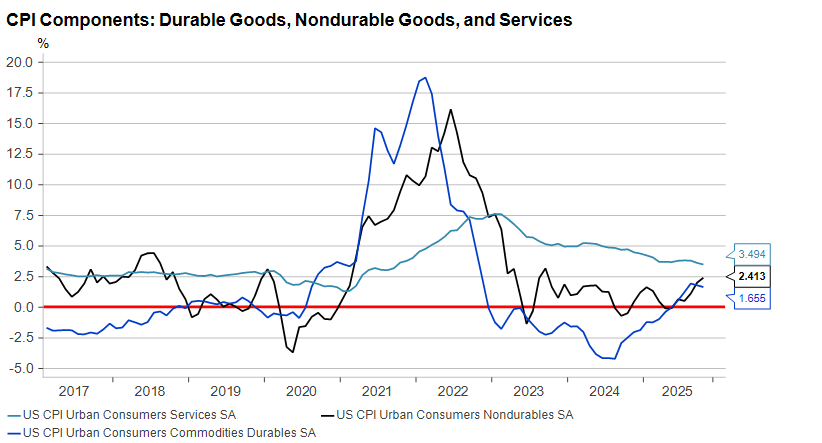

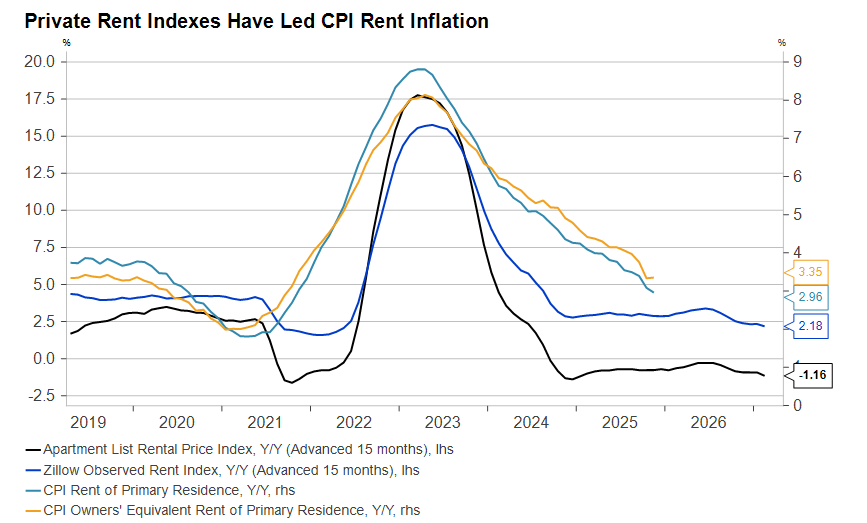

2. Inflation as the Key Concern for Policy Makers and Markets: Inflation is so 2022. While goods prices rose in 2025 as companies passed tariff costs onto consumers, services inflation – dominated by shelter – seems likely to remain subdued, and the tariff effects will start to fade by the middle of 2026. Moderating wage growth indicates little upside risk to price inflation from the labor market. Of course, we will have to watch oil and energy prices as wild cards for inflation in 2026.

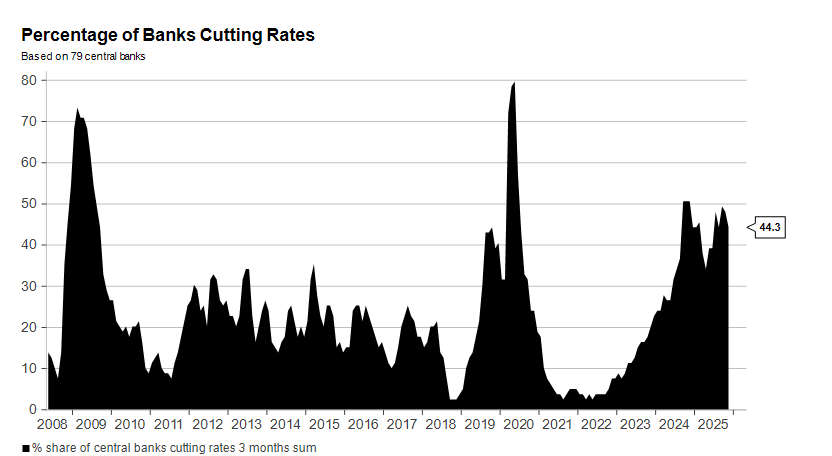

3. Global Easing Cycle into a Resilient Growth Backdrop is Slowing: Both 2024 and 2025 have been years of global central bank easing, all while overall global GDP growth remained near 3%. This kind of concerted easing without economic weakness has been a powerful backdrop for global risk assets, which enjoyed the added liquidity and the resilient growth expectations. Going into 2026, multiple developed market central banks are set to pause their easing cycles (even the Fed, which is currently expected to cut rates two more times in 2026, had its Chairman say that rates were “effectively” at neutral), unless, of course, more pronounced economic weakness were to develop, but this would be less welcome by risk assets.

The Charts of Christmas Present

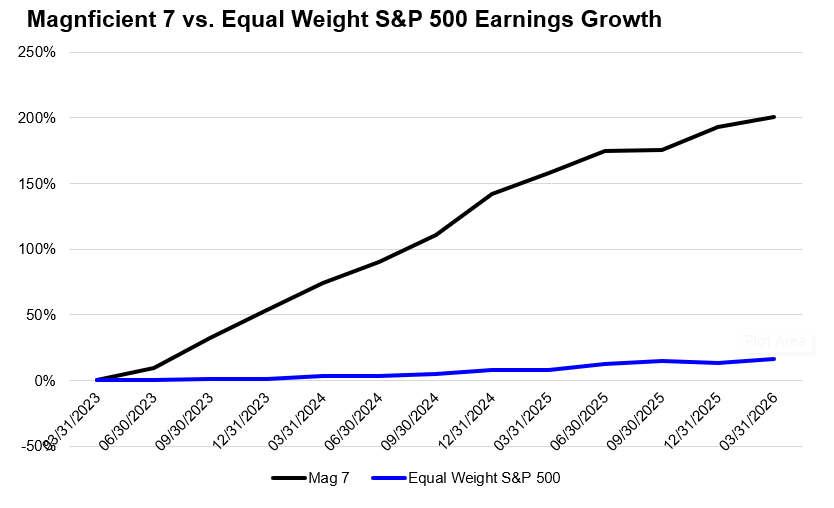

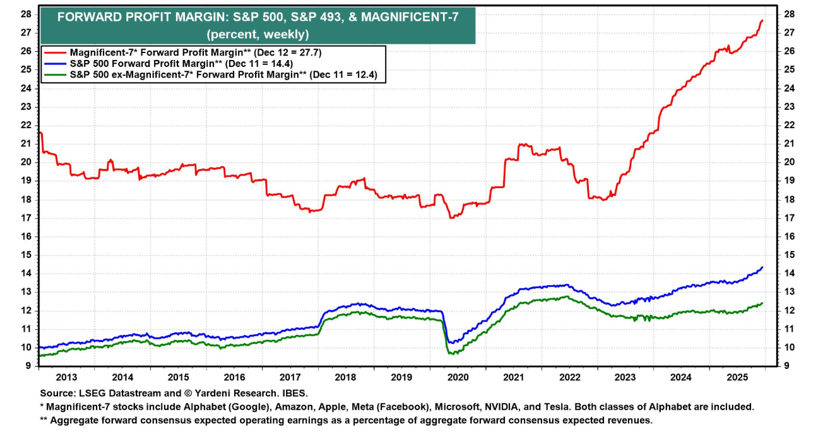

1. Magnificent 7 Earnings vs. Everyone Else: The last three years have been incredibly powerful for Magnificent 7 earnings growth. While the “average stock” (the equal weight S&P 500) has grown earnings by a meager 16%, the Magnificent 7 has delivered an astounding 200% earnings growth (as shown in the first chart below). The question for 2026 is if the extraordinary margin expansion of the last three years from the Magnificent 7 (as seen in the second chart below that shows 10 percentage points of margin expansion over the last three years) can be sustained going forward as these companies spend more money on capex and face steeper competition from new innovative entrants. Further, consensus is expecting a substantial rebound in “everything else” earnings growth in 2026.

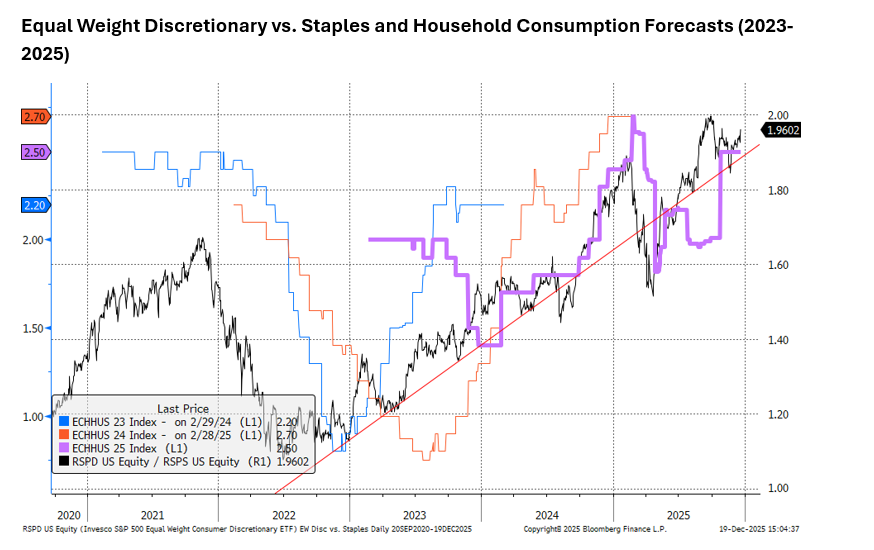

2. The Equity Market’s Signal About the Consumer: For all of the consternation about the US consumer over the last year (poor sentiment readings, clear divergences in financial health of high and low income households), the equity market was clear in its signal that it judged the aggregate US consumer (which benefits from the large weight of healthy, high income households) was still resilient. The ratio of Equal Weight Discretionary vs. Staples stocks, a barometer of cyclical vs. defensive or risk on vs. risk off for the US consumer, remains in an uptrend, suggesting continued expectations for resilient aggregate household consumption.

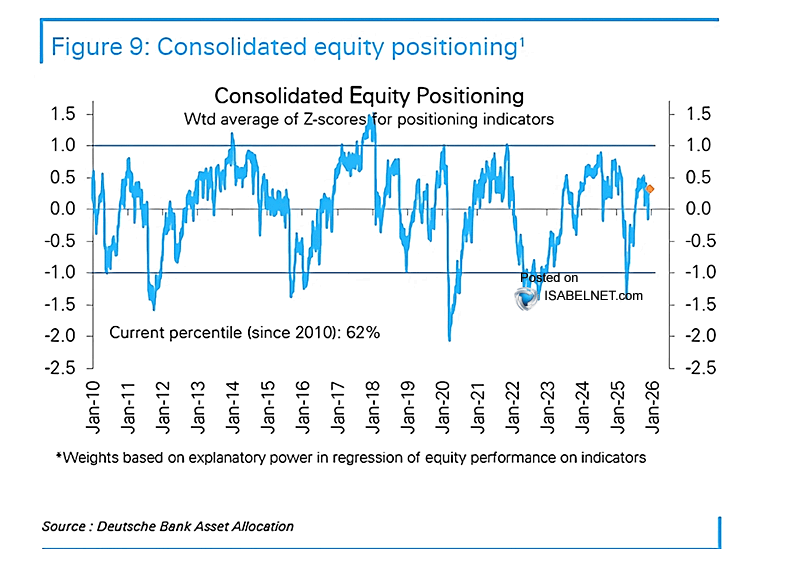

3. Non-Stretched Positioning Giving the Rally Legs: If there is one thing U.S. equity markets should be grateful for in 2025, it is that institutional investors became so resolutely bearish and underweight markets in April. As Liberation Day scared institutional investors into reducing equity positions (to the 1st percentile in a 15-year period, meaning investors were more underweight the market only 1% of the time!), it created a powerful tailwind as money was pulled back into the market. The most recent reading of the 62nd percentile shows investors are slightly overweight but not nearly as stretched as they were at the start of this year, or in years like 2022 and 2018.

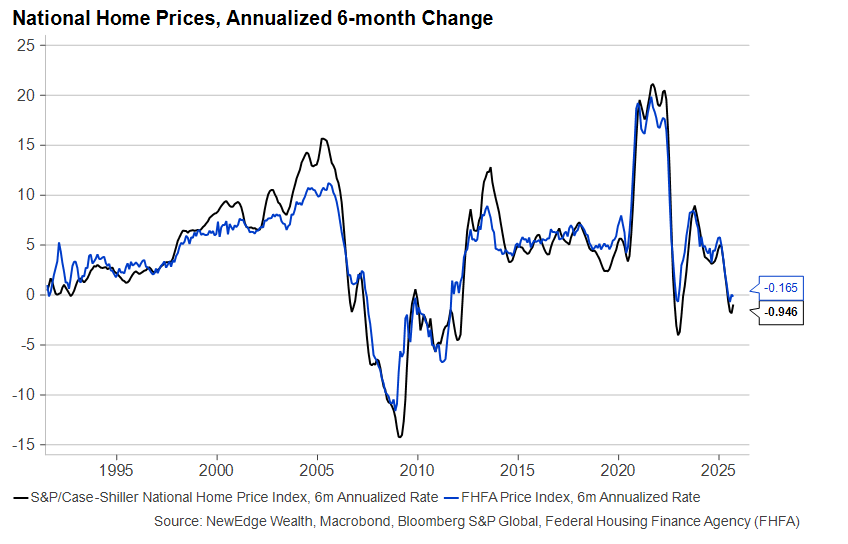

4. Housing Remains in the Doldrums: Mortgage rates have come down a little and sales have picked up, but prices are under pressure and builders have stopped hiring and are taking on fewer new projects. Home prices are not likely to collapse in 2026, but households are no longer feeling the powerful tailwind of the wealth effect from their home values. What could change this in 2026? A rapid increase in supply seems unlikely, and a significant but benign (i.e., no recession) drop in interest rates may be too much to hope for.

Charts of Christmas Yet to Come

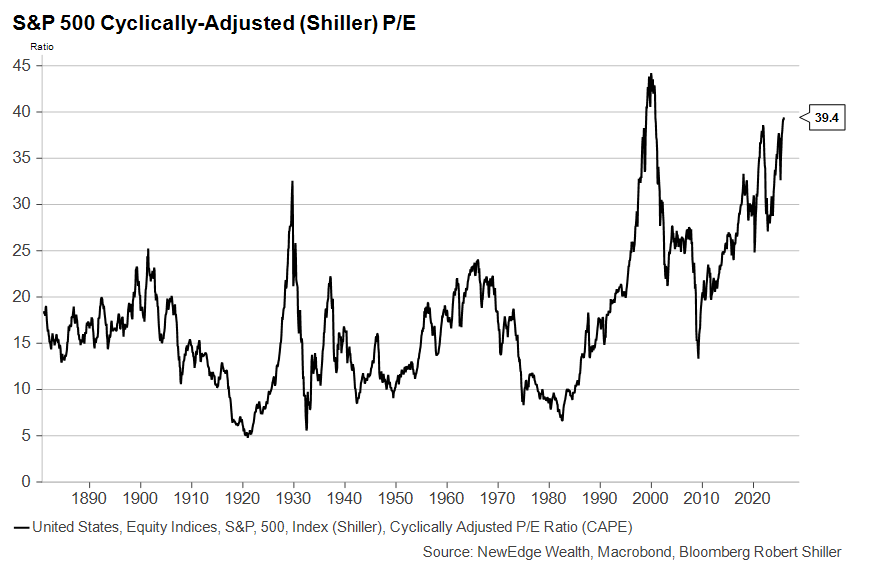

1. The Starting Point of Valuations and Earnings Estimates: U.S. Large-Cap Equity valuations have only been higher in one brief period in history: the last few years of the 1990s. High valuations today are not a harbinger of immediate doom, but they do tend to be followed by prolonged periods of subdued average returns (or even a “lost decade”). The reason why valuations are a poor timing tool (a topic we have written extensively about in recent years) is because a catalyst is needed to cause a sustained shift in appetite and capacity to take risk. As we have been in an environment where liquidity has remained abundant (thanks to the Fed), and growth has remained resilient (thanks to the Magnificent 7 shown above), overall valuations have been able to defy gravity back to prior highs. We see high valuations potentially adding to volatility through the year, as there is ever-less room for further expansion and more potential for compression. On earnings, estimates are for a robust 14% earnings growth next year to $310/share for the S&P 500 (implying both an acceleration in revenue growth and well over 100 bps of margin expansion). With this, it is difficult to argue that forecasts are low for earnings, as they already reflect a strong economy and a veritable boom in productivity.

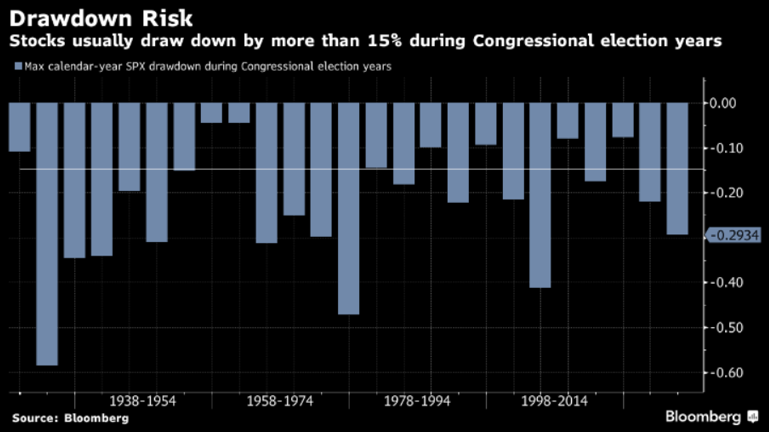

2. Potential for Drawdowns in 2026: Volatility is a feature of equity market investing, even though the last eight months have delivered very little of it. As we look to 2026, it would not be surprising to see an uplift in volatility, given the valuation and earnings dynamics outlined above, along with the historical precedent to see larger drawdowns in midterm election years. The chart below shows an average drawdown of 15% during midterm election years, which could be seen as an opportunity for investors who have liquidity to invest.

3. Consumer Spending Faces Falling Real Income Growth: Consumer spending growth remained resilient in 2025 in the face of resurgent goods prices and a weakening labor market. Ultimately, however, the same gravity exerting downward pressure on wage growth will affect housing spending, as well. Falling real income growth is a key source of concern for 2026.

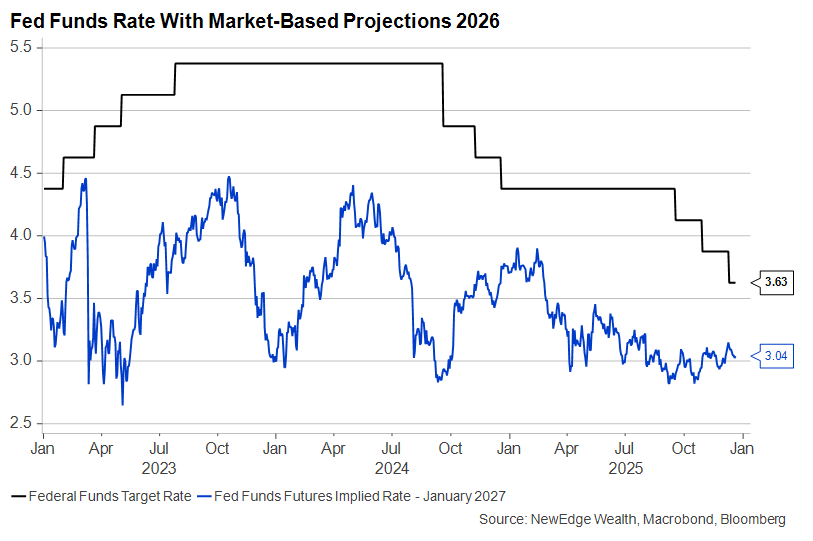

4. Where is Neutral and Can the New Fed Chairman Get Rates Below That Level: Markets have doubted all along – even during the Liberation Day turmoil – that the Federal Reserve would ultimately have to cut rates below 3%. Even today, investors barely expect a return to this so-called neutral rate by the end of next year. But weakness in the labor market could lead to a repricing of Fed expectations as soon as the first quarter.

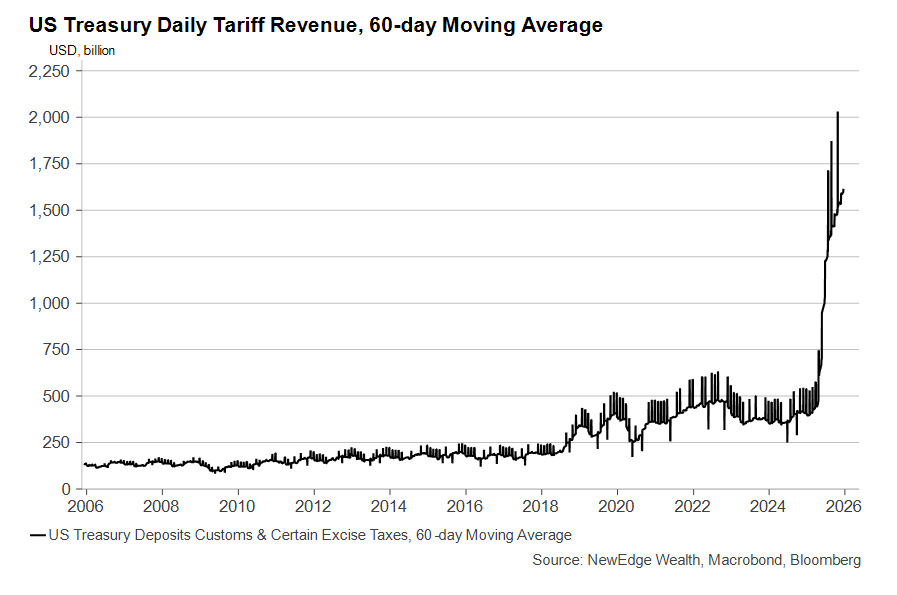

5. Tariff Today, Gone Tomorrow?: The U.S. Supreme Court could ignite a firestorm on trade policy if it decides to invalidate many of the tariffs put in place this year. While the Trump administration could use other means to maintain tariff rates close to where they are now (on average, at least), refunds to U.S. companies that paid duties in 2025 could constitute the most contentious and unintentional fiscal stimulus in memory.

Conclusion: Wishing You All a Happy Holidays

2025 has been a fascinating year. We’ve said it often throughout the year that: time flies when you live in interesting times!

We hope that just as the Muppets made Dickens’ serious Christmas tale even more relatable, that our Muppets-guided charts helped make today’s economic and market landscape more relatable as well.

So, as we go into 2026, we hope that Gonzo’s accurate delivery of the Dickens’ prose, emphasizing that Tiny Tim did NOT die, will also apply to the continued life of this equity bull market!

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC

The post The Muppet Charts Carol appeared first on NewEdge Wealth.