And all that I want from you

Is a promise you will be there

Say you will be there

“Say You’ll Be There”, Spice Girls

It may not be a broadly appreciated factoid that the Spice Girls began as a fabricated pop group. Seeing the success of boy bands in the 1990s, Heart Management set out to start a girl group, running an advert in the UK newspaper, The Stage, that read: “R. U. 18-23 with the ability to sing/dance? R. U. streetwise, outgoing, ambitious, and dedicated?” The five young women selected from the auditions eventually broke away from their manufactured roots at Heart Management, morphing into the strong, independent purveyors of “girl power” that remain iconic to this day.

These fabricated roots remind us of today’s tariff turmoil, as the market volatility and economic uncertainty of the last month was expressly fabricated and self-inflicted by policy decisions.

The question going forward is what this self-inflicted tariff uncertainty will morph into as time goes on. Will tariffs prove to be a mere inconvenience to U.S. consumers and corporations, with these entities being able to absorb and navigate the impacts without a significant hit to the economy? Or, will these tariffs prove to be a more detrimental force, weighing on consumer spending, corporate profits, and overall economic health?

The answer to these questions largely depends on how long the enacted onerous tariff rates remain (such as the current 145% tariff rate on Chinese imports), whether or not the Rose Garden tariff table is enacted after the 90 day “pause”, and the timing of any progress on “deals” that result in an easing of today’s tariff rates. The longer these dependent factors remain unanswered, the more likely we are to experience the second scenario of a bigger hit to the U.S. economy.

But as equity markets stage roaring rallies back to pre-Liberation Day levels, it appears that they are pricing with greater certainty in the first scenario, that tariffs will have a digestible impact on profits and the U.S. economy. This implies that equity markets are optimistic that “deals” will get done and that the majority of the Rose Garden Tariff Table will not be enacted.

Effectively, the equity market is looking at the Trump administration pleading: “Say you will be there” to walk back tariffs and make this risk to the economy fade rapidly from our memories (much like the Spice Girls’ flop of a third album, Forever).

“Throwing Far Too Much Emotion At Me” – Continued Light Positioning and Sour Sentiment

After an 18% rally off of the April 7th intraday lows and just completing a nine-day winning streak, the longest run since 2004, we must unpack the source of this strength in order to determine if it can continue.

There has been of course a relief in tariff headline uncertainty (hard to get worse than those first few days of April!), with some easing of rhetoric and softening of stances. However, we think the majority of this upside move has been driven by a positioning chase back into equities after institutional investors became deeply underweight stocks in early April.

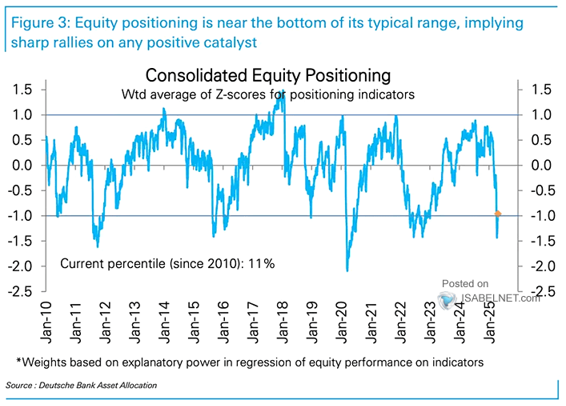

As we have been flagging in our Monday charts and this Weekly Edge, the Deutsche Bank Consolidated Positioning Report got to just the 2nd percentile in mid-April, meaning only 2% of the time in the period of this measure had institutional investors been more underweight equities. Further, sentiment measures reached extreme levels of pessimism in early April, supporting the notion of a low bar for surprises to the upside. This kind of extreme underweight positioning and sour sentiment means that it does not take a lot of good news to draw investors back into the market.

The Deutsche Bank measure of positioning remains depressed at just the 11th percentile as of April 26th, still well below “neutral” and a far cry from the 96th percentile that was flagged as a risk to start 2025. It will be fascinating to see how rapidly this measure moves higher, given the last week of strength.

Because positioning remains so light amongst institutional investors (measures of trend following hedge fund positioning remain in the “underweight” territory as well), we see potential that the “pain trade” for equity markets may still be higher. Said another way, recent strength has caught institutional investors flat-footed, and they are still having to chase equity markets higher.

There is a strong consensus that the S&P 500 could face formidable resistance at ~5,700 (the 200-day moving average), but given how underweight positioning remains, we would not be surprised if the “pain trade” pushed the index above these levels for a brief period of time. Note that if the market were to defy resistance and press higher, the risk/reward for further upside would become increasingly unattractive.

Importantly, we are expecting downside volatility to resume eventually as the real economic impact of tariffs begins to be seen with greater clarity in data, but we must remain attune to areas of “crowded consensus” where the market could do what is least expected (we have lovingly been calling this the Honey Badger Market, in honor of the animal that excels in doing the unexpected).

“But Any Fool Can See They’re Falling” – Growth Forecasts Getting Cut

Appreciating that positioning is a powerful short-term driver of markets helps us to make sense of how markets could be so strong (and expensive at 20.5x forward PE on the S&P 500!) despite pronounced uncertainty about the path forward for corporate profits and the economy.

On the corporate profit front, since Liberation Day, we have seen ~$5 removed from S&P 500 EPS estimates in both 2025 (now at $265) and 2026 (now at $295). We think there is likely still downside to these estimates, as record operating margins are still being baked into reach these earnings numbers.

Given signs that cost pressures are pronounced (see national and regional manufacturing surveys), but pricing power is fading (hear commentary from retail earnings about companies having to absorb more of the tariff costs), we see risk to operating margins in the near term. Further downside to profits would come from further downside to economic growth.

On the economic growth front, labor and GDP data from this week helped investors breathe some sighs of relief, but there is little to glean from this backward-looking data other than to say that the U.S. economy was (thankfully) healthy going into this period of uncertainty.

As we detailed in our 2Q25 Outlook, “The Space Between” and in last week’s Weekly Edge, “The Eye of the Hurricane”, we think it is going to take time for the true effects of tariffs to impact broad economic data.

First, we are still in the era of the pull forward of demand, as ample evidence is available (despite what AAPL said about their first quarter results!) that consumers have accelerated purchases of items that are feared to have price hikes from tariffs.

Second, if companies are going to eventually lay off workers due to weaker demand or supply disruptions, we think these headcount reductions could take time to be seen in the broad economic data. We expect to begin to see weakness in Transportation & Logistics and Leisure & Hospitality as soon as the May jobs data, given these two areas are seeing the most immediate impact from the tariff actions, but other industries may choose to wait to reduce headcount. The scars from the 2020-2021 labor shortages remain in employers’ psyches, while the flip-flop, on-again-off-again tariff announcements likely push employers to hope that tariffs can be walked back. However, as we noted above, the longer these tariffs remain, the greater the negative economic impact they are likely to have.

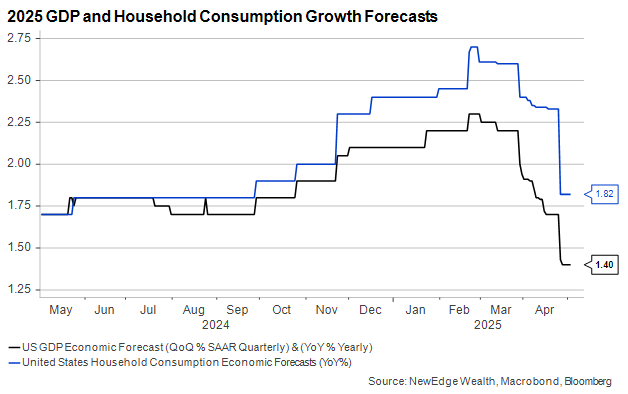

Current consensus has cut GDP and household consumption forecasts for 2025 sharply, with the degree of further cuts to these estimates highly dependent on any progress on tariff resolution.

“Tell Me, Will Tis Déjà vu Never End?” – Conclusion

Equity markets have roared back from their “liberated” lows with a gusto that resembles a crowd of tweens welcoming the Spice Girls to the stage in the late 1990s. We think this equity strength has been driven by how oversold equities became in early April, with both positioning and sentiment becoming extremely washed out. We note that measures of positioning and sentiment have not rebounded as much as the market has, suggesting the “pain trade” could still be higher, but also note that the risk/reward for further upside is looking increasingly unattractive.

We do expect volatility to resume, post this positioning recalibration, driven by the reality of falling GDP and EPS estimates that are getting pressured by the economic reality of onerous “fabricated” tariffs. The longer the current tariffs remain, the more likely we will see a greater hit to US economic growth, meaning that the equity market at these levels is certainly begging the trump administration to “be there” with the pivot and to back away from tariffs.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC

The post Say You’ll Be There appeared first on NewEdge Wealth.