New division brings EdgeCo Holdings wealth management companies under one brand name

PITTSBURGH, Pa. – November 1, 2021 – EdgeCo Holdings, LP (“EdgeCo”) is pleased to announce the launch of NewEdge Capital Group, the official brand of the firm’s wealth management division. The launch of NewEdge Capital Group brings together several of the wealth management operations EdgeCo has launched or acquired since 2018. Under the new brand name, NewEdge Capital Group operations include:

- NewEdge Advisors, LLC, an SEC registered investment adviser for independent financial advisors.

- NewEdge Wealth, LLC, an SEC registered investment adviser EdgeCo designed to meet the needs of ultra high net worth, family office and institutional clients.

- NewEdge Securities, Inc., a FINRA registered broker-dealer.

NewEdge Advisors, LLC was created through the merger of Mid Atlantic Financial Management with Goss Advisors, LLC, which was acquired at the end of 2020. This subsidiary provides independent advisory practices a better way to serve clients and manage time and expenses more effectively than they could independently. NewEdge Advisors is a partnership of established advisors created to make independence easier, more enjoyable and ultimately more successful.

NewEdge Wealth, previously launched by EdgeCo in December 2020, provides a select group of ultra high net worth clients the ultimate level of service and attention to help simplify, organize and manage the demands their wealth has on their lives today, while also delivering a customized wealth strategy to help achieve their legacy for tomorrow and beyond. NewEdge Wealth combines the benefits and safety that ultra high net worth clients require, the flexibility and choice that can be offered by independent advisors and access to technology that typically only large firms can deliver.

NewEdge Securities, Inc. is the firm’s FINRA registered broker-dealer, previously known as Mid Atlantic Capital Corporation. NewEdge Securities also offers NewEdge Institutional Trading, which provides customized trading solutions and technology to the firm’s affiliated registered representatives and investment advisors as well as over 300 institutional clients, including some of the nation’s largest banks, money managers and hedge funds.

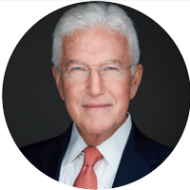

“We are excited to align each of these highly complementary companies. As independents, these businesses have operated successfully and we expect them to perform even better with shared resources,” said Charles Warden, Chairman of NewEdge Capital Group, LLC. Mr. Warden founded Mid Atlantic Capital Corporation in the 1980s and in addition to serving as Chairman of NewEdge Capital Group, LLC, he is also a member of the Board of Directors of EdgeCo Holdings LP. When describing the vision for the company moving forward, Mr. Warden stated: “NewEdge is all about bringing an ‘edge’ to the wealth management space. We continually strive to sharpen the tools of our industry, and we believe NewEdge Capital Group brings together top talent, technology and services that ultimately better serve our clients and affiliated advisors.”

About NewEdge Capital Group

NewEdge Capital Group and its subsidiaries collectively trace their roots back over 40 years and provide best-in-class technology-enabled solutions and support services to financial advisors and their clients. Today, NewEdge Capital Group has over $27 billion in client assets and supports over 300 financial advisors across more than 75,000 client accounts. For more information, visit www.newedgecapitalgroup.com.

About EdgeCo Holdings

Through its subsidiaries, EdgeCo Holdings is a leading provider of best-in-class, technology-enabled solutions for financial intermediaries and their clients. For over four decades, EdgeCo companies have provided a suite of technology and support services, including full-service retirement plan administration, brokerage, advisory, and trust and custody services to a diverse national client base of financial intermediaries. This client base includes registered representatives, investment advisors and other financial intermediaries, including retirement plan recordkeepers, TPAs, bank trust departments, broker dealers and insurance companies. The firm services approximately $160 billion in client assets under custody or administration and more than 15,000 financial advisors and 500 financial institutions.

Media Contact

Christopher Broussard

Chief Marketing Officer

800-693-7800 x271