“I haven’t even finished eating all my Halloween candy!”

We hope our NewEdge Wealth clients and readers are having a wonderful Thanksgiving week. Whether you’re reading this in advance of the big day or after, as your body digests the feast, we offer this edition of the Weekly Edge for your consumption. In it, you’ll find a collection of charts showing some of the macro trends for which we are most thankful this year.

Following that, we’ll offer some thoughts on the upcoming Fed meeting. What’s driven the abrupt shift in consensus toward a December rate cut? And how much of this “good” thing is too much? (The second question may also be relevant to those of us who overindulge on stuffing every year.)

To inspire us along the way, we’ll be drawing on quotes from the 1973 classic short, “A Charlie Brown Thanksgiving”.

“What have I got to be thankful for?”

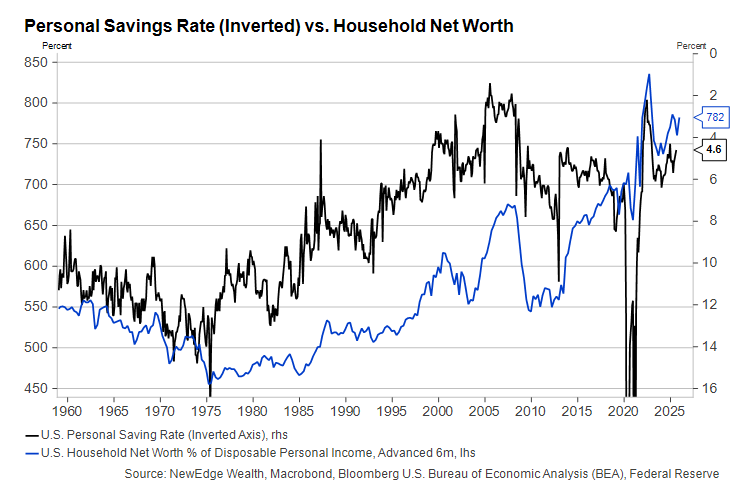

As investors, we are immensely thankful for the simultaneous rallies in just about every major asset class (sorry, crypto!) so far in 2025. Risk appetite and strong earnings growth have driven stocks, while softer economic data and easier monetary policy have lifted bonds. If this unlikely equilibrium lasts, we must first and foremost thank the wealth effect. Rising equity prices have been supporting spending growth:

As household net worth increases, savings rates tend to decline. And the lack of sharp equity market pullbacks since April have given consumers (those who own financial assets, anyway) the green light to spend more and save less.

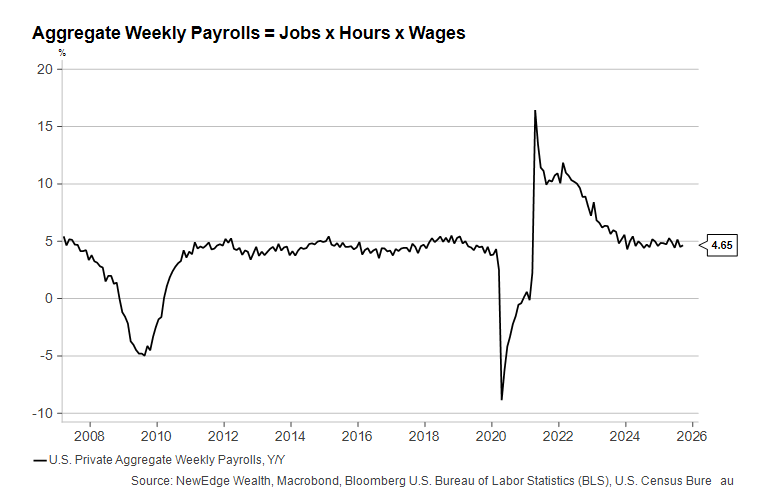

Second, we are thankful that the labor market has remained healthy enough to allow real incomes to rise by nearly 1% this year even after government transfer payments and inflation are excluded. This chart taken from the monthly employment report’s household survey shows that total payroll growth (a figure that accounts for changes in the number of workers, the length of the workweek, and hourly wages) remains steady and healthy:

Third, despite headlines announcing both public- and private-sector layoffs, jobless claims have thankfully remained historically low:

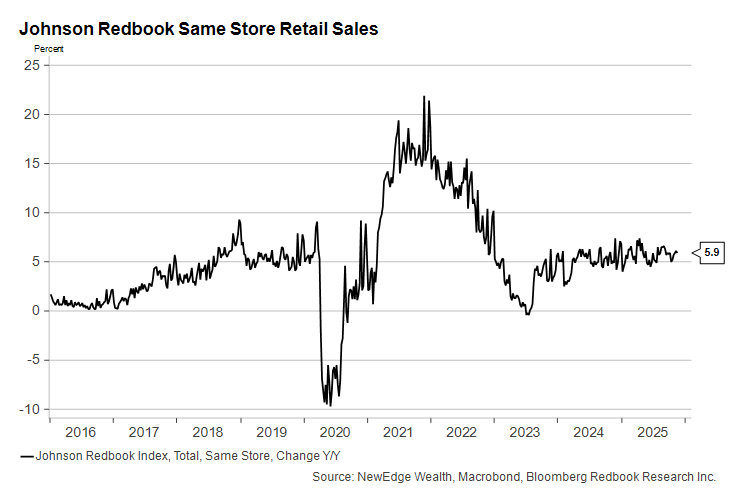

Next, consumers with greater job security tend to spend more money, and the private sector retail sales data we have been receiving in uninterrupted fashion before, during, and after the U.S. federal government shutdown indicates no pullback:

Last, while credit issues have been popping up in the headlines more frequently of late, corporate bond issuers continue to exhibit broad stability. We are thankful that this segment of the global financial market, which so often acts as the canary in the coalmine singing the first unhappy tune of a crisis or recession, has remained quiet:

As the chart above shows, spreads have moved out only modestly amid the recent bout of broader volatility. Further widening from here would be concerning, but a narrowing back to the year’s lows would be bullish.

“You know I’m too brusque and rough. You go and speak for me.”

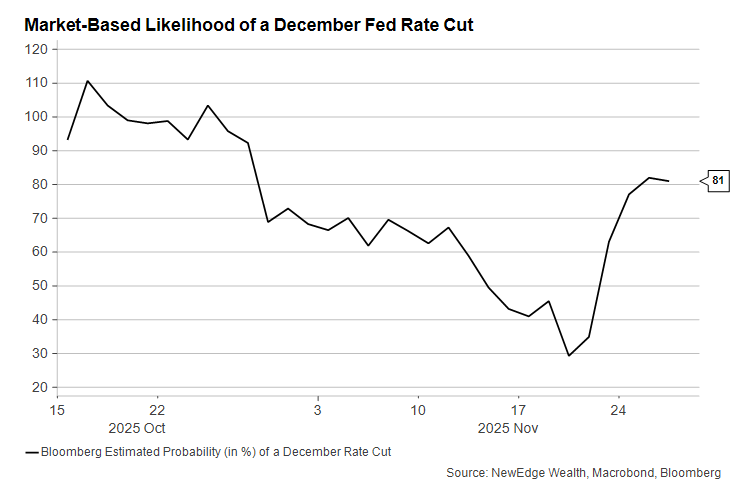

As recently as a few days ago, we did not think we would be able to add a December Federal Reserve interest rate cut to our list of things to be thankful for. Fed Chair Jay Powell was notably noncommittal at his October press conference on the potential for further easing this year, leading many to conclude that his bias coming into the final meeting of the year was to hold steady.

As of just a week ago, the market-based odds of a third 2025 cut were less than one in three as the Bureau of Labor Statistics a) released a tame September inflation report; and b) announced the next jobs report (likely to be a poor one supporting the case for a cut) would not be released until after the Fed meeting.

That was before New York Fed President John Williams (a permanent voting member of the FOMC) chimed in last Friday with his support for another cut. This allies him with the more dovish members of the Board of Governors, a few of whom are being tipped to become Chair next year when Powell’s term is up. Williams was joined this week by colleagues like San Francisco Fed President Mary Daly, who is not a voting member but is normally closely aligned with Powell, who himself has not publicly opined on policy in the past week:

“Well, there’s only one thing wrong with that.”

Stocks have rallied this year whenever prospects for Fed rate cuts have brightened. We saw this September when the cuts began and, again, over the past week. But the stocks that rally the hardest in these periods tend to be those of companies with considerable leverage and weaker profitability, which we do not normally view as good long-term investment signals.

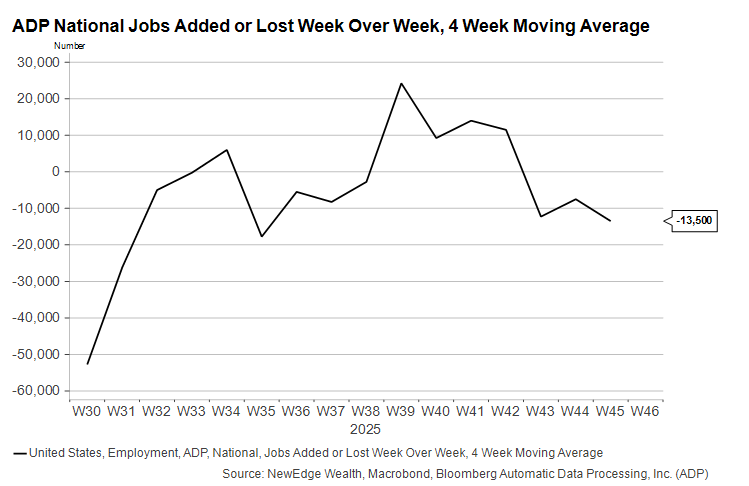

Moreover, when we look at the rationale behind the Fed’s apparent dovish shift, we are less sure of how thankful to be that it may feel the need to step in. Rate cut proponents generally cite the softening labor market as their key source of concern. Indeed, high-frequency payroll data shows employers shedding jobs each week:

Payroll growth is weak due to a combination of cyclical weakness (low demand growth) and immigration restrictions (low supply growth). The next few months of employment data should also show the effect of the defunct Department of Government Efficiency (DOGE) cuts from earlier in the year. Many employees whose jobs were eliminated or who accepted buyouts have only recently come off the federal payroll.

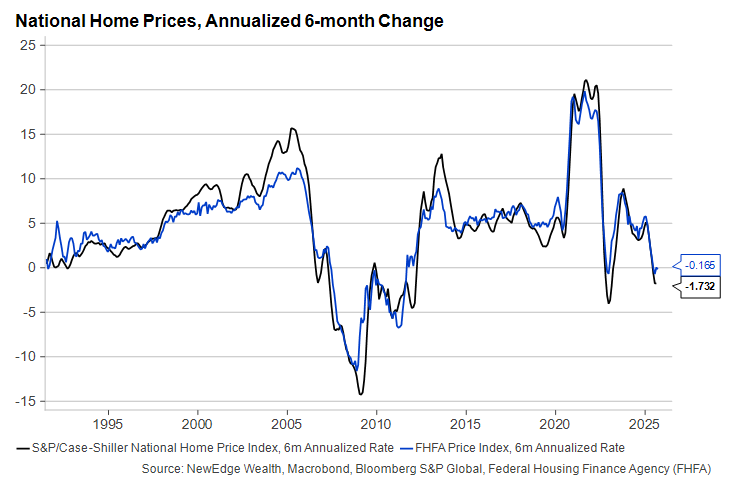

But economic weakness goes beyond the labor market. Redfin reported this week that a rising percentage of listed homes are being pulled off the market due to softer prices and a lack of buyers. National home prices have moved lower in the first nine months of the year, according to S&P. And rents on new leases have been declining based on data from Apartment List, which leads the shelter components of CPI inflation by a year or more.

“I can’t believe it. She must think I’m the stupidest person alive!”

The final entry on our list of things to be thankful for is the fact that “soft” economic data (e.g., consumer confidence) forecasting a household spending pullback has thus far been a string of false positives. While more accurate leading indicators of the economy would certainly be helpful, we are grateful that consumers’ abysmal self-reported economic assessment and outlook has not translated into Great Depression-like drops in consumption.

Unlike Charlie Brown, who continually believes Lucy will finally – finally! – let him kick the football (“She wouldn’t try to trick me on a traditional holiday!”), markets have largely stopped paying attention to headlines about “the worst consumer outlook since…”. Add this to the list of things for which we are grateful.

We wish you all a very Happy Thanksgiving and a prosperous start to the holiday season!

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC

The post Giving Thanks appeared first on NewEdge Wealth.